do pastors pay taxes on their income

Example of pastors W-2 instructions. Major federal programs and agencies included the Civilian Conservation Corps CCC the Civil Works Administration CWA the Farm Security Administration FSA the National Industrial Recovery.

And cuz i do blames me for bitching all the time- he does nothing good ough.

. PayScale Some priests pastors clerics and rabbis receive free housing as part of their calling. Either way the government is getting your money. Use your income forecast as the base to allocate funds to different ministries to reach their individual and collective goals.

However certain income of a church or religious organization may be. Fourth the US tax system is a pay-as-you-go system. Note that we did not include the tax-free amount of 1500 accountable reimbursements It would not be reported anywhere on the W-2.

Include his base salary of 25000 his unaccountable car allowance of 2500 and the 6000 social security tax allowance in Box 1. Dear Jill I am a single 60 yr. We Have A Pay-As-You-Go Tax System.

But he wants more and im only human with w babies Everythings me. Is that my fault. I am forced to do this because my employer refuses to pay me a liveable wage and provide benefits.

You Can Too But Youll Have to Ask for It. We help you understand and meet your federal tax responsibilities. Philippines Charismatic Pastors Step Up Evangelism In Devastated Mindanao.

That means that you pay income taxes as an employee but pay payroll taxes Social Security and Medicare taxes as if you were self-employed. But the church should not withhold FICA payroll tax from the pastors income because. For paid work try Anywork Anywhere and for international positions that exchange free housing for work try WWOOF.

God calls pastors to be examples to the flock 1 Pet. Fill out the information boxes a b c e and f. One place to start is asking each ministry department leaderlike your missions director or youth pastorto submit their own department budget based on their goals needs and resources.

12 And what I am doing I will continue to do in order to undermine the claim of those who would like to claim that in their boasted mission they work on the same terms as we do. Apply to the IRS for tax-exempt status unless their gross receipts do not normally. Pastors living in a furnished parsonage provided by their church can still claim a housing allowance for other home costs.

If they choose to do so voluntarily theyre required to pay the fee for. Old man living in the basement of my mothers house. Heres how these taxes are handled for members of the clergy.

Because you have to pay the taxes yourself if you dont. The New Deal was a series of programs public work projects financial reforms and regulations enacted by President Franklin D. Get your refund status.

This is a common and costly mistake. They may designate a portion of their earnings as housing allowance on which they do not pay federal income tax. So all church leaders sin.

Churches are exempt from paying unemployment taxes in the majority of states according to an article in Church Law and TaxWhile churches have the option to pay unemployment taxes voluntarily those instances are rare so the employees of these. While they dont pay for web content they do compensate for content used in their print magazine. Find IRS forms and answers to tax questions.

Adopted Son Upset At Parents Because They Wont Pay For His College Like They Did For Their Biological Kids. To protest government military spending some Mennonites withhold all or a portion of their federal income taxes in an act of faithful civil disobedience. This Single Mom Got a 9000 Refund on Her Student Loans.

Organizations are generally exempt from income tax and receive other favorable treatment under the tax law. Thats why he stays away. News about political parties political campaigns world and international politics politics news headlines plus in-depth features and.

13 For such men. Some provide free housing although not all pay well or at all. Reports indicate the rate is around 020 per word.

He leaves for weeks after manipulating me to give him my income taxes as an investment 2500 and now hes gone for weeks at a time and wants me to say nothing. They must pay. With Bidens announcement of student loan cancellation many eligible.

Thats why we have employer. Its only going to get worse during this Obama Depression because employers know that there are millions unemployed so they have reduced their pay. 51-4No pastor is perfect and yet pastors ought to give us a living picture of Christian maturity and Christlikeness.

A pastor typically pays their own payroll taxes as if they were self-employed. Members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld. Serial fraud Joe Biden repeatedly promised middle-class Americans wouldnt pay a penny more in taxes in his administration.

Any unused portion of your housing allowance will become part of your total income subject to taxes. Ministers pastors and other members of the clergy are required to pay Federal Income tax on their salary. In 1983 congregational delegates of General Conference Mennonite Church a predecessor of Mennonite Church USA passed A Resolution on Faithful Action Toward Tax Withholding.

Keep in mind that there are some exceptions to the unemployment eligibility rules which differ from state to state. Roosevelt in the United States between 1933 and 1939. No wonder character qualities make up the majority of the biblical qualifications for pastorselders in the New Testament see 1 Tim.

Focused on Christian and Jewish perspectives First Things is a popular publication that accepts articles book reviews and opinion pieces. Since they have dual status as self-employed and as an employee of the church a churchs pastor would receive a W-2 at the end of the year to show the income theyve received. And like the rest of us if you dont have an employer withholding those taxes on a regular basis then you have to pay quarterly estimated taxes four times a year.

Like the rest of us you pastors have to pay federal income tax. So churches dont have to withhold income taxes for their pastors but they can.

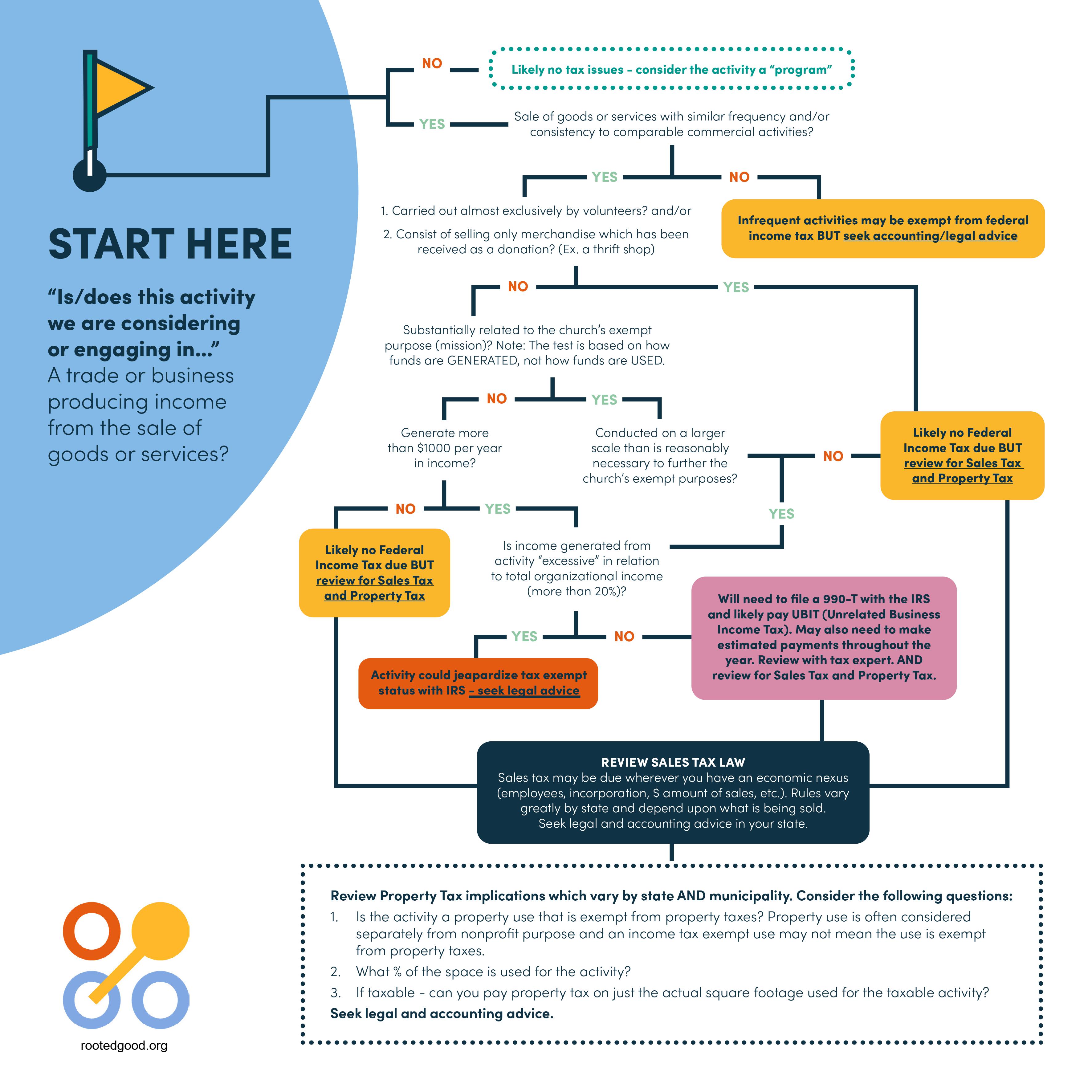

Our Church Is Making Money Or Thinking About It What About Taxes Faith And Leadership

How To Read And Understand Your Form W 2 At Tax Time Tax Forms W2 Forms Tax

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

Tax Prep Do You Know If You Have A Tax Lien On Your Property How To Find Out Tax Help Tax Prep

Your Pathway To Becoming An Enrolled Agent Enrolled Agent Tax Prep Checklist Continuing Education

What Is A 1099 And Why Did I Get One Irs Tax Forms Tax Forms What Is A 1099

Calculator With Text On Screen Tax Concept Stock Photo Aff Screen Text Calculator Tax Ad Deduction Tax Tax Forms

Christian Principles For Managing Money

Irwin Mcgraw Hill C The Mcgraw Hill Companies Inc 2000 Principles Of Taxation Chapter 4 Basic Maxims Of Income T Income Tax Mcgraw Hill Education Mcgraw Hill

Equipping Pastors To Master Their Personal Finances Pastor Health Insurance Companies Finance

Dual Tax Status What Does It Mean For Your Pastor American Church Group Texas

Income Tax And Ni Basics 2020 Income Tax Income Business Infographic

Why Do Church Employees Pay Income Tax Quora

Jeet Ig Expert On Instagram How To Save A Lot Of Taxes People Are Always On The Lookout For Opportunities To Save Income Tax No O Income Tax Income Tax

Picture Of A Hand Opening A Door With Blog Post Title 2020 Housing Allowance For Pastors What You Need To Know Housing Allowance Allowance Pastor

How Much Would The Government Tax On A Canadian 300k Salary Quora

Clergy Tax Status Explained Leaderlab Uua Org

How Much Would The Government Tax On A Canadian 300k Salary Quora