maricopa county tax lien foreclosure process

Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

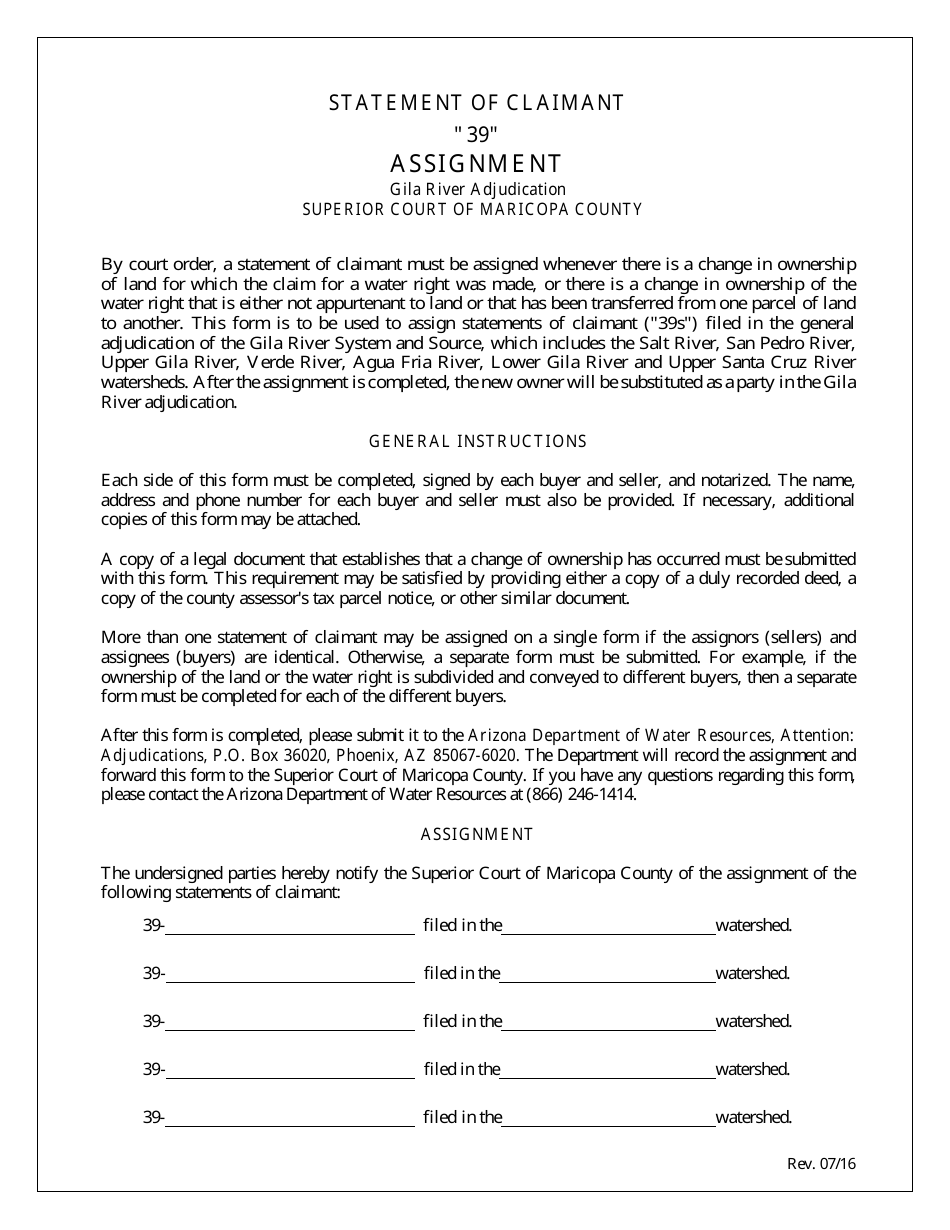

Maricopa County Arizona Assignment Of Statement Of Claimant Gila River Adjudication Download Fillable Pdf Templateroller

Next enter your buyer number click the Register Here button and follow the prompts to.

. Maricopa County CA tax liens available in CA. If you have not yet registered start by pressing the Tax Lien Web button on the Treasurers website home page in the Investor section. Shop around and act fast.

All groups and messages. You have to wait three years after you buy the tax lien certificates to foreclose. Those liens with deadlines that are already in.

Find the best deals on the market in Maricopa AZ and buy a property up to 50 percent below market value. TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library. Introduction to Tax Lien Foreclosures In Arizona tax liens are sold at a public auction every February.

Pursuant to this legislation tax liens eligible for expiration will include the original certificate and all related sub taxes in the expiration process. Except Federal Holidays Customer Service. Shop around and act fast on a new real estate.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. If the property owner is in bankruptcy you cannot use this. Judicial Foreclosure The judicial process of foreclosure is now required for tax lien holders.

Now what May 7 2021 1125. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. A cashiers check in the amount of 1108000 made out to Flood Control District of Maricopa County is required to be an eligible bidder.

8am - 5pm Monday - Friday. You must have registered separately for the Tax Lien Web feature. The above parcel will be sold at Public Auction on.

Find the best deals on the market in Maricopa County CA and buy a property up to 50 percent below market value. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor. Buying Selling Real Estate Discussion Found a property with a tax lien against it.

There are currently 11375 tax lien-related investment opportunities in Maricopa County AZ including tax lien foreclosure properties that are either available for sale or worth pursuing. HUD VA and Tax Sales AZ Tax Lien Foreclosure Feb 16 2020 1647. These listings may be used as a general starting point for your research.

Maricopa County County AZ tax liens available in AZ. Delinquent and Unsold Parcels. In order for the State to return these parcels to the tax rolls through a tax-deeded land sale Maricopa County must first offer the parcels at a public auction in which anyone may bid on.

Call the Mohave County Treasurer at 928 7530737 or 800 420- 6352 and ask whether the - property owner is in bankruptcy. Maricopa AZ tax liens available in AZ. After three years from the date of the tax lien sale but no later than 10 years the CP holder may begin a judicial foreclosure action to obtain ownership of the property.

Judicial foreclosure involves filing a lawsuit with the court to obtain a court order to foreclose. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. If the tax lien is not redeemed within the specified timeframe then youll have the opportunity to pursue a foreclosure on the property.

That would mean that as of 2013 you can foreclosure any tax lien certificate purchased in 2010. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor.

He had been buying liens in maricopa. The amount owed in taxes becomes the amount of the lien but the. What is the tax deed process.

Find the best deals on the market in Maricopa County County AZ and buy a property up to 50 percent below market value. Maricopa County AZ currently has 17634 tax liens available as of May 1. Any certificate holder including the County may file an Action to Foreclose in the Superior Court of Maricopa County three years from the date of.

Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. General Foreclosure.

Eastmark No 1 Eastmark No 2 And Cadence Cfd City Of Mesa

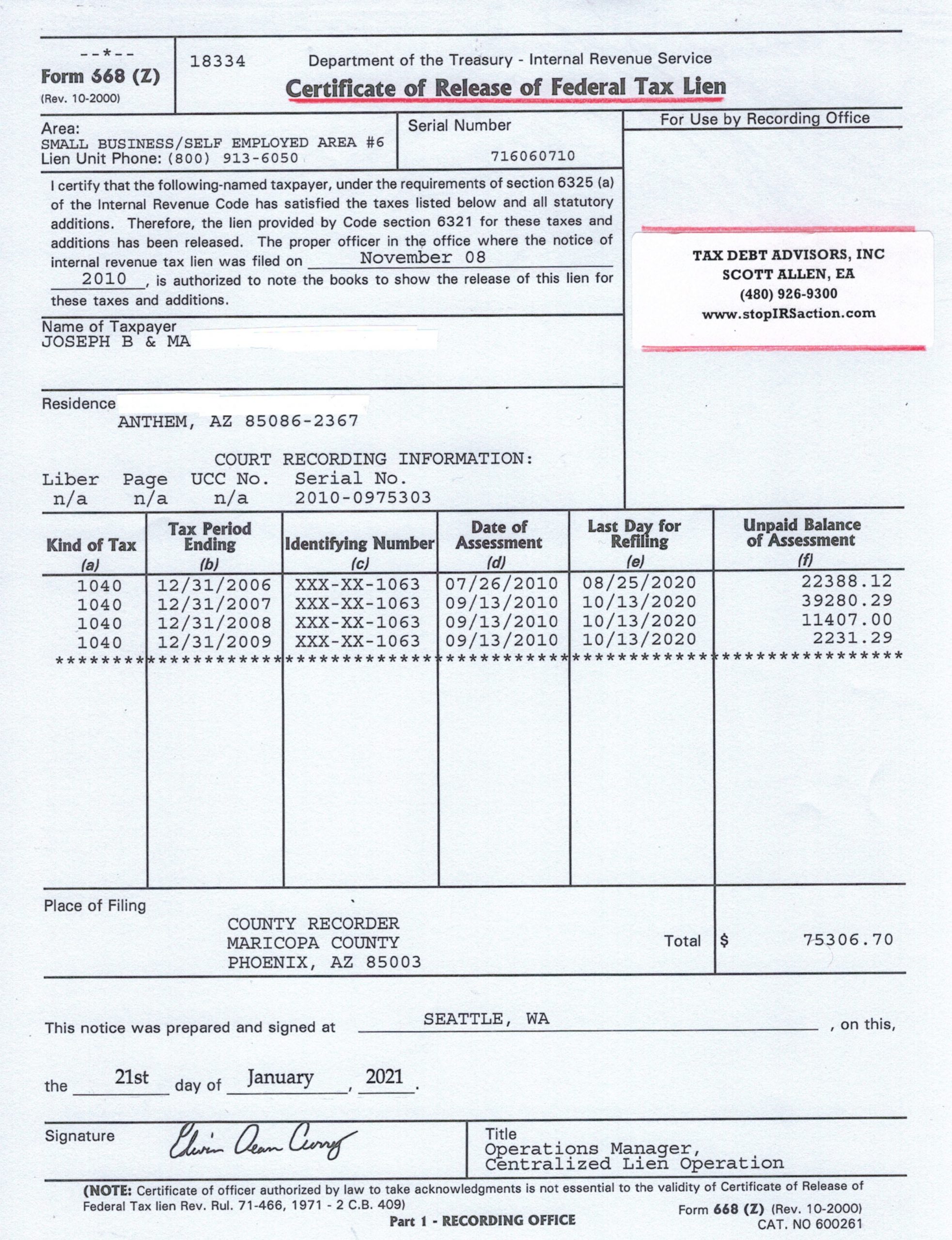

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

The Statutory Requirements For Purchasing Redeeming And Foreclosing On Tax Liens In Arizona Provident Lawyers

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate Ktar Com

Az Tax Liens And Tax Foreclosures Arizona Real Estate License Exam Prep Youtube

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

An Interview With The Maricopa County Treasurer Asreb

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Pha Annual Plan 2021 2022 Housing Authority Of Maricopa County